Vaccine updates

Click on your state to find vaccine roll-out updates by region.

Prepare for HR implications of vaccines

From the desk of Adriane Harrison

The arrival of COVID-19 vaccines has raised questions about whether employers can require their employees to be vaccinated. The Equal Employment Opportunity Commission recently provided guidance about vaccinations for employees, allowing for mandatory vaccination with some exceptions. If an employee does not receive the vaccine under those exceptions, the employer must determine whether the unvaccinated person presents a direct threat to the health and safety of their coworkers. It is a good idea to update job descriptions now in anticipation of these potential analyses.

If there is no available reasonable accommodation, then the employer can remove the employee from the workplace. Do not terminate that person’s employment without a consultation with an employment attorney, who will be able to determine all strategies and make sure no laws are being broken.

OSHA has released updated guidance for employers to use which includes updates such as making COVID-19 vaccines available at no cost to all eligible employees, not distinguishing between workers who are vaccinated and those who are not, and minimize the negative impact of quarantine and isolation on workers. Read full guidance below.

COVID-19 Facts

HR / Employment

Unused FFCRA hours still accessible in 2021

Although FFCRA was not officially renewed, employers can opt to extend unused benefits from the FFCRA through the end of March and the company will be reimbursed with payroll tax credits. For instance, if an employee did not use a portion of their 80 hours before the end of the year, the company can extend their availability through March 31. Similarly, the FMLA expansion would qualify, too.

Workshare programs by state

During economic slowdowns, you have resources when reducing employees hours. According to the National Conference of State Legislatures, “Workshare programs let businesses temporarily reduce the hours of their employees, instead of laying them off during economic downturns. Technically referred to as short time compensation, the goal of worksharing programs is to reduce unemployment.” You must apply.

Financial Resources

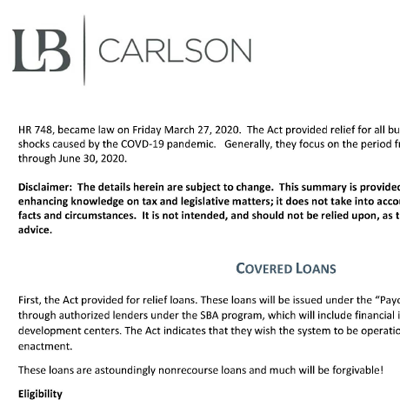

Loan, cash flow guidance

Accounting firm and trusted partner LB Carlson has released a series of articles regarding important details from the latest stimulus package and more. For those looking for guidance navigating PPP loans, taxes, succession planning or profitability maximization, consider reaching out directly to LB Carlson for print industry specific guidance.

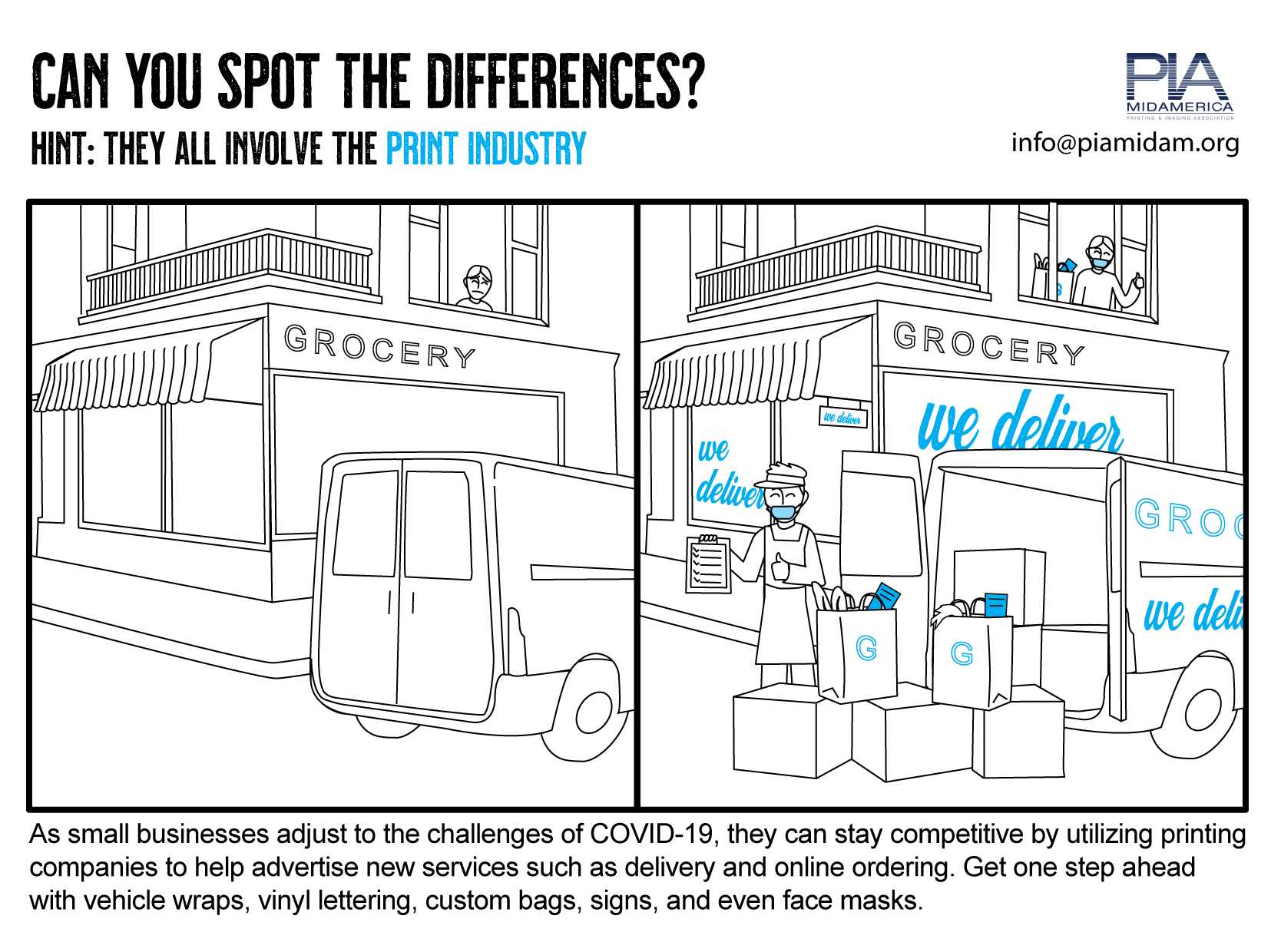

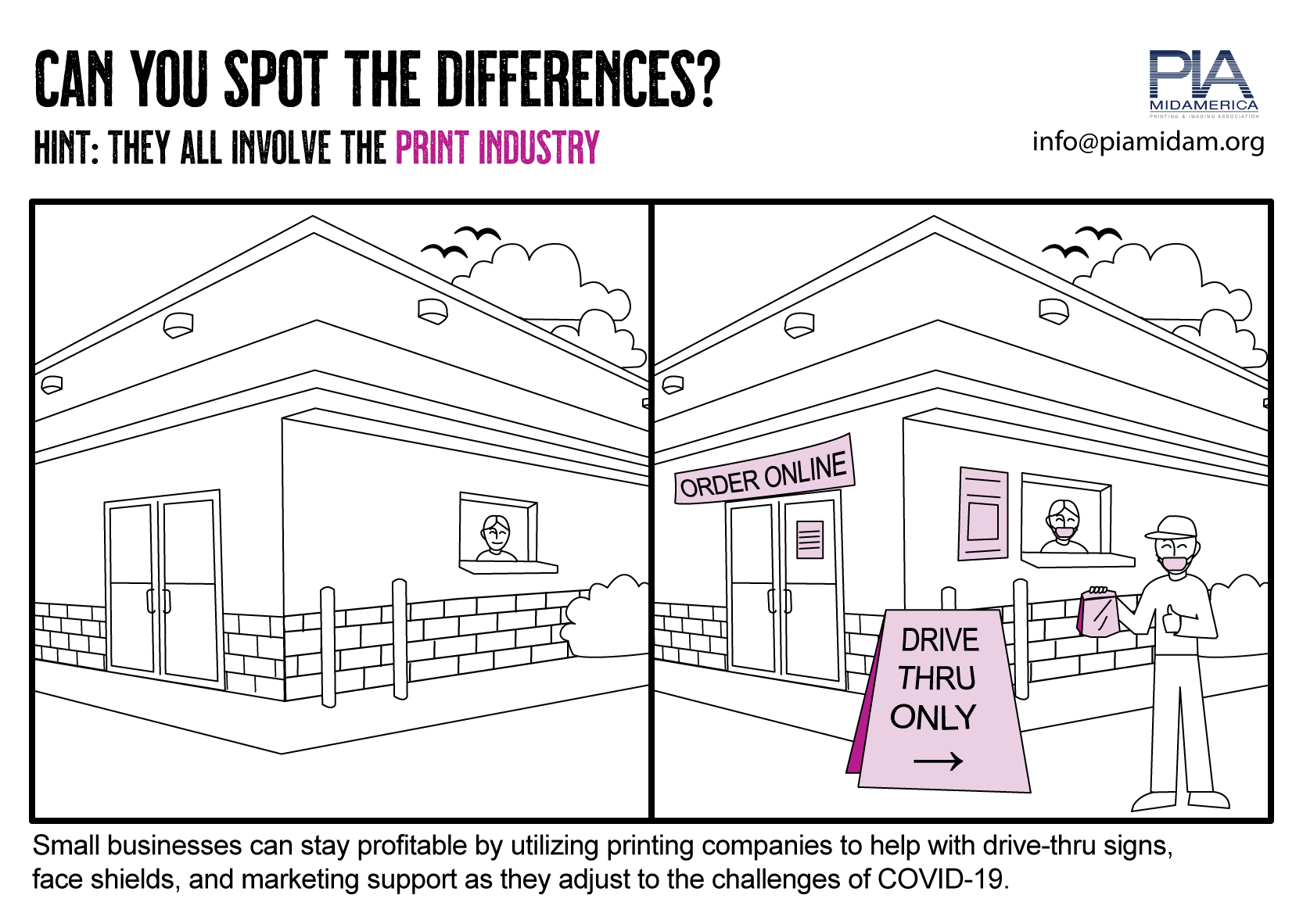

Workplace Safety

Find a partner

If you need to outsource work no matter the reason during this time, find a PIA MidAmerica member to partner with. Network and utlize each other’s strengths. We’re stronger together.

Connect with safety professionals

OSHA regulations, trainings and worker safety are still critical parts of operating. We have three expert PIA MidAmerica safety professionals who can help you stay up-to-date on compliance. Be sure to message us to connect with a one and keep your workers safe.

Advocacy

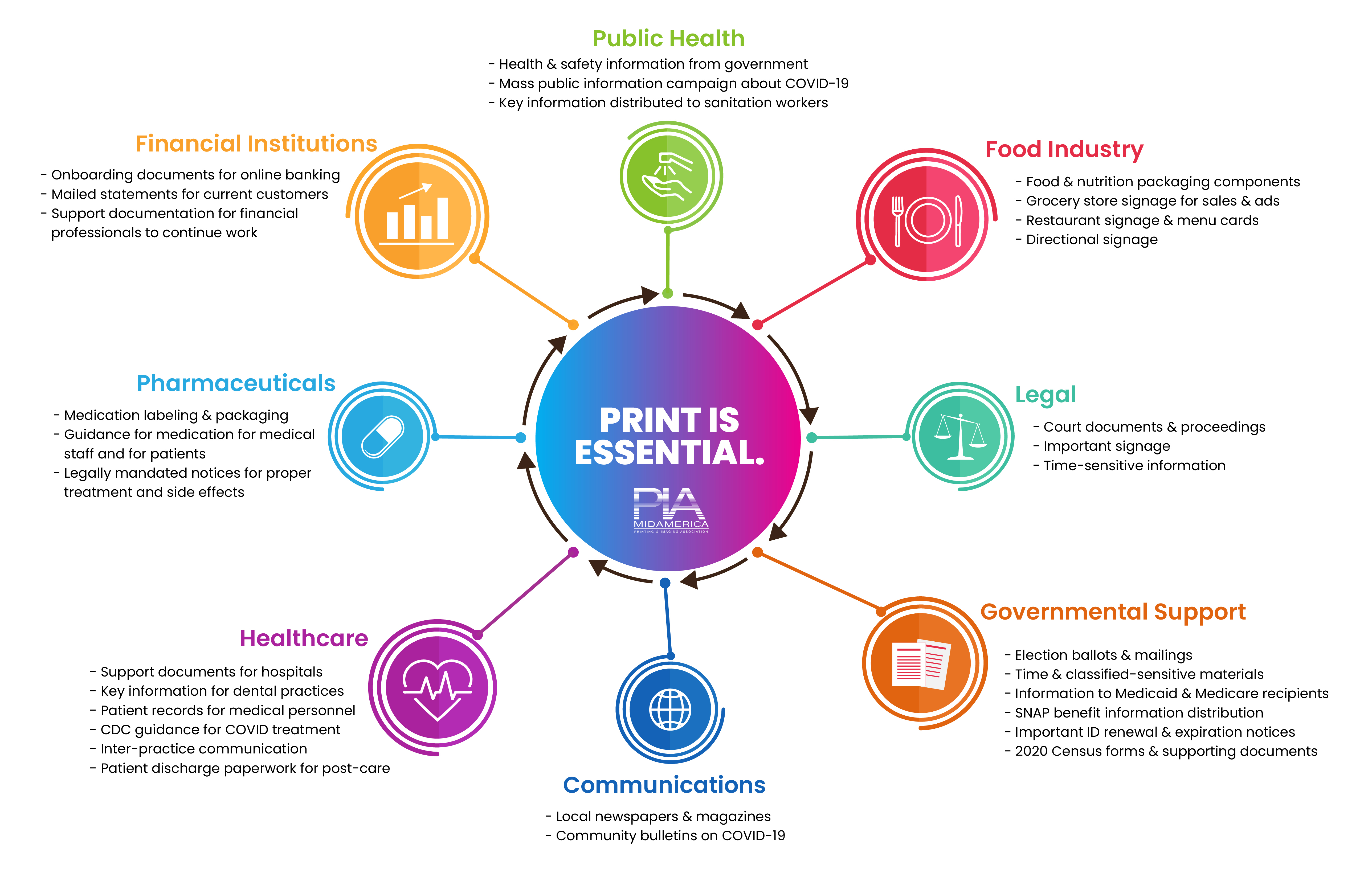

Identifying ‘Critical Infrastructure’ sectors

There are 16 critical infrastructure sectors whose assets, systems and networks — whether physical or virtual — are considered so vital to the United States that their incapacitation or destruction would have a debilitating effect on security, national economic security, national public health or safety or any combination thereof.